During the past two years, real estate market has faced immense challenges due to the pandemic, all the disruptions in the supply chains and increasing construction materials costs on a global level, which have all started having a significant impact on projects under construction and those planned to start.

Year 2021 has witnessed approximately 30% greater volume of investments in commercial real estate as compared to 2020, whereas the market segment that attracted most investments has remained to be tourism, i.e., investments in hotels and retail market.

The office uprising…

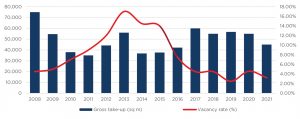

During 2021, Zagreb office market take-up levels were amounting 61.000 sqm, which combined with a limited new supply resulted in the lowest vacancy rate among all the capitals in the region, equaling only 3.23%.

Interestingly, when we are analyzing market sentiment towards work from home, according to our researches IT sector accounted for 55% of all office space transactions in terms of new leases, which clearly shows that the main demand driver, which has been the leader and the creator of all changes especially those related to work models, is still investing and developing office work model as the indispensable, since it is not easy to replace all the infrastructure office space offers as compared to work from home model.

Rental levels for modern office space remained stable, ranging between 10-13e per sq m for Class B offices and 14-16e per sq m for Class A office space, while we are witnessing stronger and stronger pressure on yields with the start of the year, due to lack of offer of investment properties, pushing the yields to 7.75-8%.

Source : CBS International

Retail…it’s all about experience…

Despite the strong increase in online sales of nearly 25% during the 2020 and 2021, we see that modern shopping malls are still attracting the customers in Croatia, with brands keeping the physical stores as the important channel of communication and experience sharing with the customers.

Likewise, in the past two years the market experienced a significant investment volume of transactions, in particular of shopping malls, but also retail parks which proved to be an excellent retail format for smaller towns and suburban city areas, while all these capital markets transactions marked stable yield levels as before the pandemic.

Retail parks as a shopping format will remain to be in focus of investors like Immofinanz, which announced a massive expansion in the next 5 years, with around 20 more retail parks throughout Croatia.

Apart from retail parks, the expansion of food retailers continues, such as Studenac and Tommy, as well as Italian retailer Europsin.

Logistic sector in the spotlight..

The winner however of all the market changes is definitely a logistics sector, which after a decade has become the key most wanted segment for investments, as a response to a growing demand for logistics facilities. During the pandemic a need for logistics spaces grew to meet the needs of end consumers, offering fast delivery and less dependence on long distance routes, and thereto securing the goods.

Croatia market marked a significant investment transaction of Quattro logistics which for the needs of acquiring the largest logistics project Business Park Zagreb, was recapitalized by insurance company Croatia osiguranje and pension funds Erste Plavi and PBZ Croatia insurance as new investors in commercial properties.

Quick bounce in tourism industry….

Croatia has played well thanks to its incredible geographic positioning and closeness of neighbouring German, Austrian and Italian markets with which we have always cherished close relations, we managed to attract Poland as the market as well as Scandinavian countries, finishing the season very successfully bearing in mind all the challenges imposed by the pandemic.

Such results have motivated both domestic and regional investors to continue unfolding their plans to invest in greenfield projects and hotels reconstruction, thereto raising the star grading and quality of services, and we do have announcements of several globally well-known hotel brands, which will further strengthen the positioning of Croatia in this part of Europe.

Croatia should use the upcoming period to attract new investments by further helping local municipalities in optimization of urban plans, ensuring more competitive communal costs in the region, with a special focus on incentivizing hi-tech and IT sectors which already accounts for a significant share in economy and stands immense potential for further growth.